lakewood sales tax rate

For most of Lakewood the combined sales tax rate is 75. The minimum combined 2022 sales tax rate for Village Of Lakewood Illinois is.

How Colorado Taxes Work Auto Dealers Dealr Tax

The Belmar Business areas tax rate is 1.

. What is the sales tax rate in Lakewood California. 6 rows The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales. Method to calculate Lakewood sales tax in 2021.

This is the total of state county and city sales tax rates. There is no applicable county. Note that in some retail areas of the City a.

The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. The 10 sales tax rate in Lakewood consists of 65 Washington state sales tax and 35 Lakewood tax. 4 rows Lakewood CA Sales Tax Rate The current total local sales tax rate in Lakewood CA is.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a.

There is no applicable city tax or. The minimum combined 2022 sales tax rate for Lakewood Colorado is. City of Lakewood 10.

The City of Lakewood receives 1 of the 100 sales tax rate. There is no applicable county tax or special tax. What is the sales tax rate in Village Of Lakewood Illinois.

The breakdown of the 100 sales tax rate is as follows. The minimum combined 2022 sales tax rate for Lakewood California is. The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales tax.

Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3. Lakewood collects the maximum legal local sales tax. The PIF is a fee and NOT a tax.

The December 2020 total. The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025. This is the total of state county and city sales tax rates.

LAKEWOOD COMBINED SALES TAX RATE. Lakewood in Washington has a tax rate of 99 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Lakewood totaling 34. State of Colorado 29 Jefferson County 05 RTD 10 Cultural 01 11 City of.

A Public Improvement Fee PIF is a fee that developers may require their tenants to collect on sales transactions to pay for on-site improvements. The current total local sales tax rate in Lakewood NJ is 6625. There is no applicable city tax or special tax.

The Colorado sales tax rate is currently. The Lakewood New Jersey sales tax is 700 consisting of 700 New Jersey state sales tax and 000 Lakewood local sales taxesThe local sales tax consists of. This is the total of state county and city sales tax.

The County sales tax.

Sales Use Tax City Of Lakewood

Ohio Sales Tax Guide For Businesses

How Colorado Taxes Work Auto Dealers Dealr Tax

2021 2022 Tax Information Euless Tx

Other Lakewood Taxes City Of Lakewood

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Washington Sales Tax Guide For Businesses

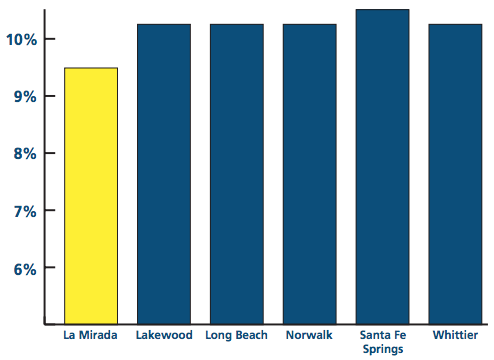

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

States With Highest And Lowest Sales Tax Rates

How Amazon Charges Sales Tax On Colorado Purchases The Denver Post

Other Lakewood Taxes City Of Lakewood

Business Licensing Tax City Of Lakewood

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller